Don't Blame Nature

Commodity prices rise and fall; no great insight there. Which is why most of us, mostly, take the fluctuations in stride. We (I) may get a little annoyed when the price of gasoline is a few cents higher than last week, and get a little boost of endorphins when it falls a few cents (maybe it’s just me).

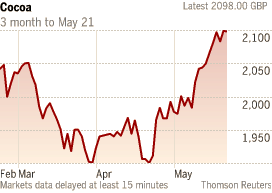

Of course, some commodities are more important than others. For me, it’s not oil or gold, wheat or pork bellies. It’s cocoa, whose price has jumped 10% in the past few weeks.

The problem is Ghana, which produces 20% of the world’s cocoa, of particularly high quality, where production is off 20% from last year. Bad weather and insects are being blamed. Mother Nature and mirids (the principal pest of cocoa plants—see below for this fearsome foe of cocoa) may be especially uncooperative this year, but the bureaucrats at Cocobod (Ghana’s governing cocoa board) are the true culprits, failing to provide financing to farmers and delivering fertilizer and pesticide late, right before the rainy season washed both away.

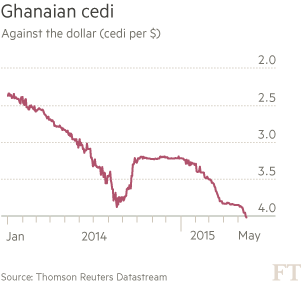

These problems pushed S&P to lower Ghana’s credit rating to B-minus, and the cedi (Ghana’s currency) is in free-fall, off 25% this year (see below).

You may think this attention on cocoa and Ghana undeserved, as there are bigger problems in the world. Fair enough, but in my defense, I see the situation as illustrative of broader themes. Uncertainty is omnipresent in all our lives, as investors or as farmers. It’s (most of the time) not acceptable to blame the weather or insects or market “volatility” on our losses. It’s often poor policies that exacerbate “normal” fluctuations into market disasters. Also, most of us probably give little thought to Ghana, but this small country is part of the global network that infiltrates all of our lives. Lastly, I really like chocolate.