Drop (in the bucket)

Markets will fluctuate, as Pierpont Morgan caustically observed. And “fluctuate” means down as well as up. Perhaps I, too, am being caustically obvious, but I’ve long believed that a broad perspective on markets can often bring more clarity than myopic obsession.

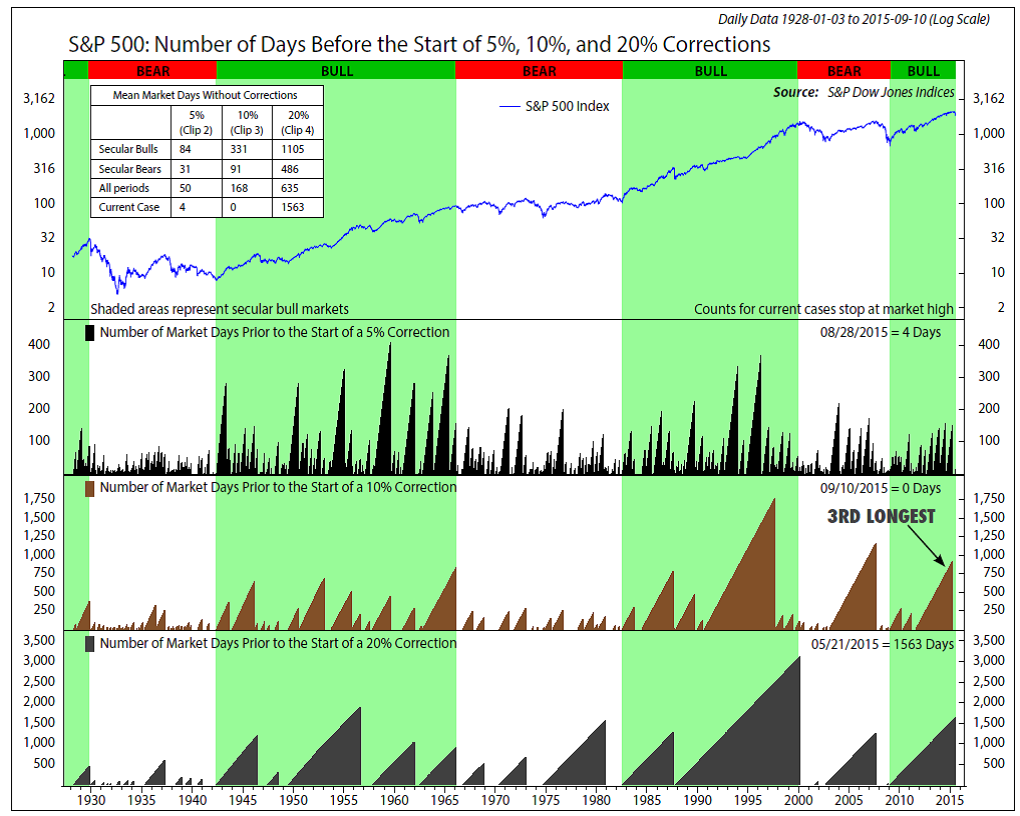

It was in 2011 that the S&P 500 Index last fell more than 10%, apparently beyond the memory of many investors who believed these corrections were relegated to ancient history, like buggy whips and handlebar moustaches. Last month the S&P dropped more than 6%, and between 21 May and 25 August of this year, declined 12.4%, ending the 3rd-longest spell (since 1928) without such a decline.

The graphic below (courtesy Ned Davis Research) plots the S&P 500 Index since 1928 (on semi-log scale) with the number of days between 5%, 10% and 20% declines. I’ll offer two observations: first, large corrections do seem to be occurring with a little less frequency than in the past, and secondly, the Index has risen from less than 5 in 1932 to around 2,000 today, declining frequently along the way. For long-term investors, the drop from 2,130 to 1,867 (May-August) is a drop in the bucket. It’s the move from 5 to 2,000 that really counts.