More on Rates...

A few days ago (Beginning’s End) I suggested 2015 might turn out to be the worst year for bond investors in the past three decades. Here are some additional pictures (courtesy of Goldman Sachs) to quantify the risks.

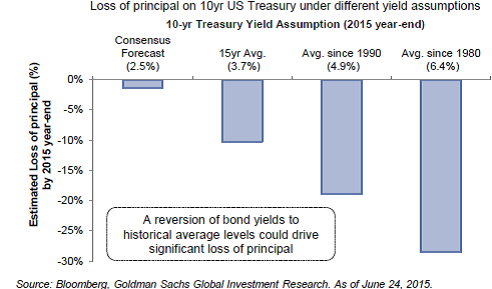

First we show the principal loss by the end of this year under various scenarios, with yields rising per current expectations or rising to historical means. The consensus expectation is for a loss greater than the current yield. Should yields revert to any of the historic means, losses would be greater.

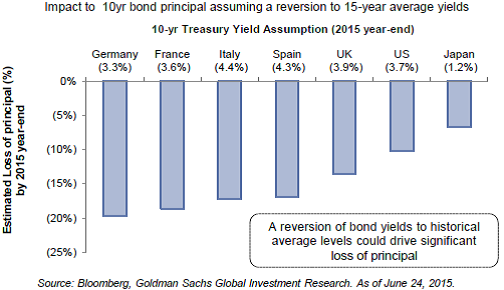

Before the tears start flowing, though, consider that US investors are likely to see losses much less than our European friends. Germans, for example, could be looking at another 20% loss of value (see Graph below). This is, of course, because US yields are substantially higher than other developed countries. At 2.47% (today), the 10-year Treasury yields more than comparable bonds in Spain or Italy (each with 10-year yields of 2.1%). French OATS yield just 1.2%, German bunds just 0.8% and JGBs 0.5%. The US offers the highest yields in the OECD.

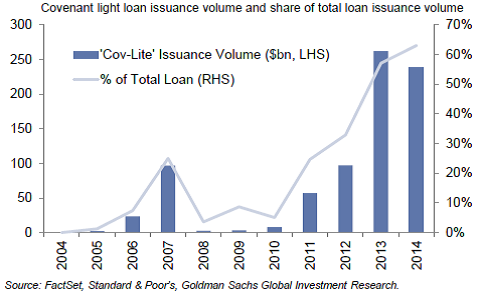

In addition to principal loss should interest rates rise, investors should also pay attention to the froth bubbling up in the high-yield (nee, “junk”) market. Loans with few, or any, covenants are at record levels, multiples ahead of the pace in 2007.

Our advice for bond investors? Caveat Emptor.