Not Dead Yet

According to the National Bureau of Economic Research (NBER), the self-acclaimed arbiter of economic debate in this country, the current economic expansion began in June 2009, meaning we just passed eight years of uninterrupted growth. This is now the third longest period of economic growth since the Civil War (see chart below). In May next year, we will pass the second-longest expansion, and if we can get to the summer of 2019 without a dip, we’ll have a new record. Will we get there? And does it matter?

The answers are, probably and yes.

To answer the first part, we have to look at what precipitates a recession in the first place. To answer that question, I draw on research by Goldman Sachs and the IMF. In the US, there is a clear demarcation pre- and post-World War Two (WW2). Pre-WW2, contractions were typically caused by cycles of over-investment followed by asset prices collapsing. Post-WW2, monetary tightening and oil price spikes explain most of the causes of recession. Interestingly, the two most recent US contractions, in 2000 and in 2008, were due mostly to overinvestment/price collapse (Internet stocks and residential housing, respectively), causes more common pre-WW2 than in the post-war period.

The IMF identifies five factors contributing to recessions in all countries over the past 50 years: fiscal policy tightening, external demand shocks, oil price spikes, monetary tightening and financial sector crises. Using this framework, the prospects for an imminent recession look dim. The first two factors, fiscal tightening and external demand shocks, have never caused a recession in the US absent the end of a major war. A spike in oil prices is always possible, but the shale revolution in North America makes that seem unlikely today. Another financial crisis is also possible, but banks have significantly delevered and shored-up capital post-2008, so a systemic collapse seems unlikely too. Monetary policy is tightening deliberately, and is an area of risk, but central bankers appear sensitive to these risks.

Not formally part of the IMF framework, but probably relevant to this discussion, is the pattern of overinvestment/asset bubbles/price collapse. Valuations are stretched across most (all?) asset classes today, so this bears watching, but I think we are not yet near the extreme levels that marked tops in the past. So while there are risks, the prospects for a true economic contraction in the near-term seems remote (not zero, but unlikely). The next question for investors is, does this matter?

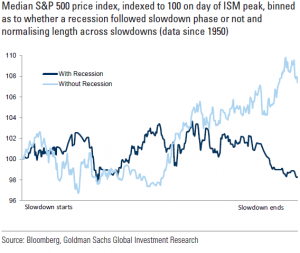

Yes it does, because asset returns are very much dependent on whether a slowdown in economic output turns into an outright contraction or not. The graph below shows equity performance during periods of slowing growth (defined as declines in the ISM Index) since 1950. If that slowdown turns into a recession, investors see negative returns (the black line). If a recession is avoided, prices rebound (blue line).

There are also market signals to watch that presage rising risks of recession and market tops. The shape of the yield curve is one. Since 1950, every recession in the US was preceded by a flat or negatively-slope yield curve (although it should be noted that the yield curve inverted in 1966 and in 1998 without precipitating an economic recession). Today, the yield curve is positively-sloped (the 10-year/90-day spread is 130 basis points today). So the yield curve is not signaling recession either.

The length of the current expansion is now the third-longest in US history, growth has been sluggish, and it is reasonable to think about when (not if) the next recession will occur. This certainly has policy implications, but is also consequential for investors. As I’ve tried to describe, while a surprise, exogenous shock pushing the economy into a recession is always a possibility, the conditions that have historically presaged an economic contraction are just not present today at levels that would give us concern.

The economic expansion is aging, the bull market is aging, (aren’t we all?). But in the immortal words of Monty Python, (neither) is dead, yet. Even mostly dead is slightly alive.