Spreads

Published: 11-18-2014

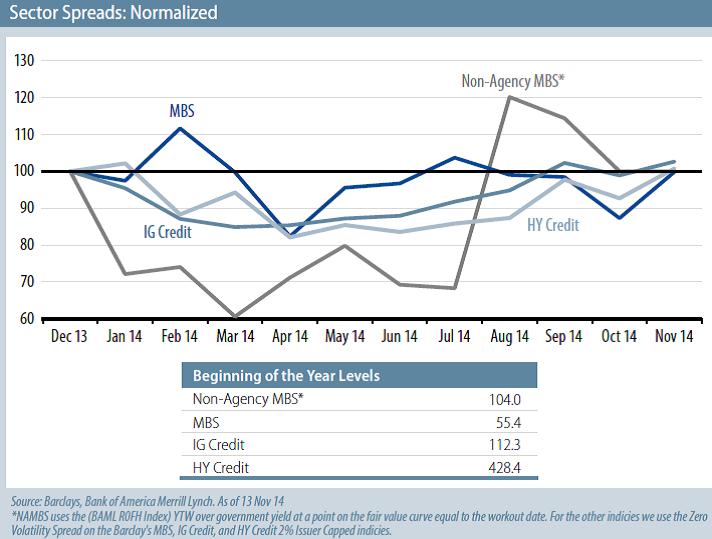

An interesting graphic from Ken Leech of Western Asset showing that spreads in Bondland this year are pretty much unchanged from the start of the year. This, despite the rally in US equities and solid economic growth. Thus, Ken concludes, spread products remain attractive.

I agree. There are numerous risks in fixed income, but that’s often the case. An economy that suddenly slumps will likely cause spread widening (although likely offset by rising bond prices). An unexpected economic boom could push bond prices lower (but spreads should hold true, if not tighten). An environment of moderate growth and low inflation should be favorable to spread products. And that’s my view.