-

-

-

![Michael Rosen]()

-

CIO Insights are written by Angeles' CIO Michael Rosen

Michael has more than 35 years experience as an institutional portfolio manager, investment strategist, trader and academic.

RSS: CIO Blog | All Media

Distortion or Reflation?

Published: 05-21-2015A month ago, Germany could borrow for 10 years at a rate of 0.06%. Lenders were also happy that day to earn 0.47% for the next 30 years. That’s $4,700 of annual interest for every $1 million. Investors were happy with this yield because the ECB was buying up all the newly issued bunds, deflation was omnipresent, and, well, Germany is a good credit.

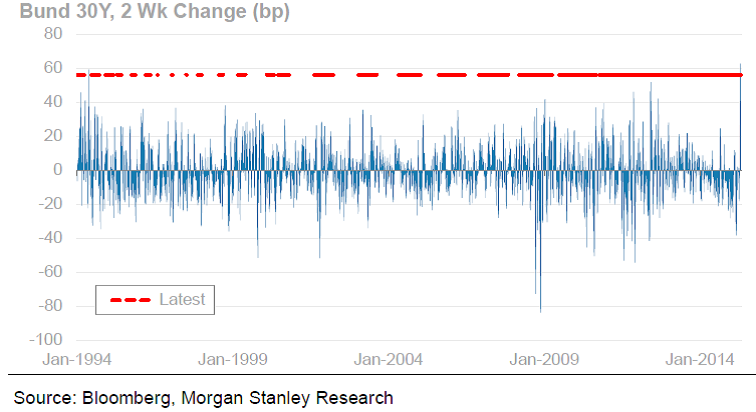

Their happiness didn’t last long, as rates jumped 70 basis points over the subsequent two weeks, wiping 0ut about 30 years of income.

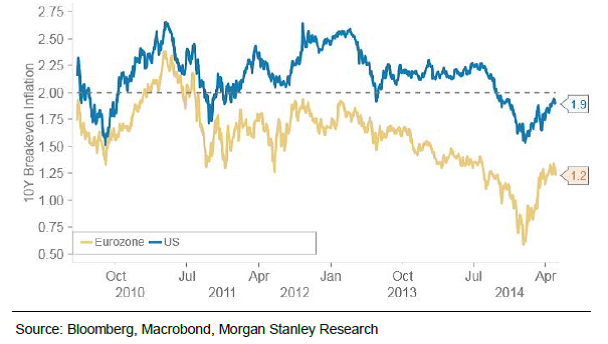

It’s logical to blame central bank meddling in the bond markets for these gyrations, but the market may also be saying that inflation may not be as dormant as suggested by these low yields. Indeed, the surge in government bond yields coincided with a notable rise in inflation expectations: by 20 basis points in the US, 45 basis points in Europe.

I don’t (never did) subscribe to the hyper-inflation scare of massively expanding central bank balance sheets, and I also think sub-1% inflation for decades to come puts too much weight on the end of economic growth and the ineffectiveness of monetary policy. Powerful deflationary forces remain, debt and demographics most prominently. And I expect central banks to continue to distort markets. But growth and inflation will (one day) return, and long-term investors are likely to be happier with a balanced portfolio of equities than the investors who lent 30 years at 0.47%.

Print this ArticleRelated Articles

-

![Spreads]() 18 Nov, 2014

18 Nov, 2014Spreads

An interesting graphic from Ken Leech of Western Asset showing that spreads in Bondland this year are pretty much ...

-

![Jobs, Jobs, Jobs]() 6 Feb, 2015

6 Feb, 2015Jobs, Jobs, Jobs

The US economy is stronger than we think: 257,000 net new jobs in January, but another 404,000 jobs were "found" (due to ...

-

![Hot As Hell]() 16 Nov, 2017

16 Nov, 2017Hot As Hell

Hell is hot, as everyone knows. Everyone knows this, but there really is no conclusive evidence: no eyewitness reports, ...

-