-

-

-

![Michael Rosen]()

-

CIO Insights are written by Angeles' CIO Michael Rosen

Michael has more than 35 years experience as an institutional portfolio manager, investment strategist, trader and academic.

RSS: CIO Blog | All Media

Dollar

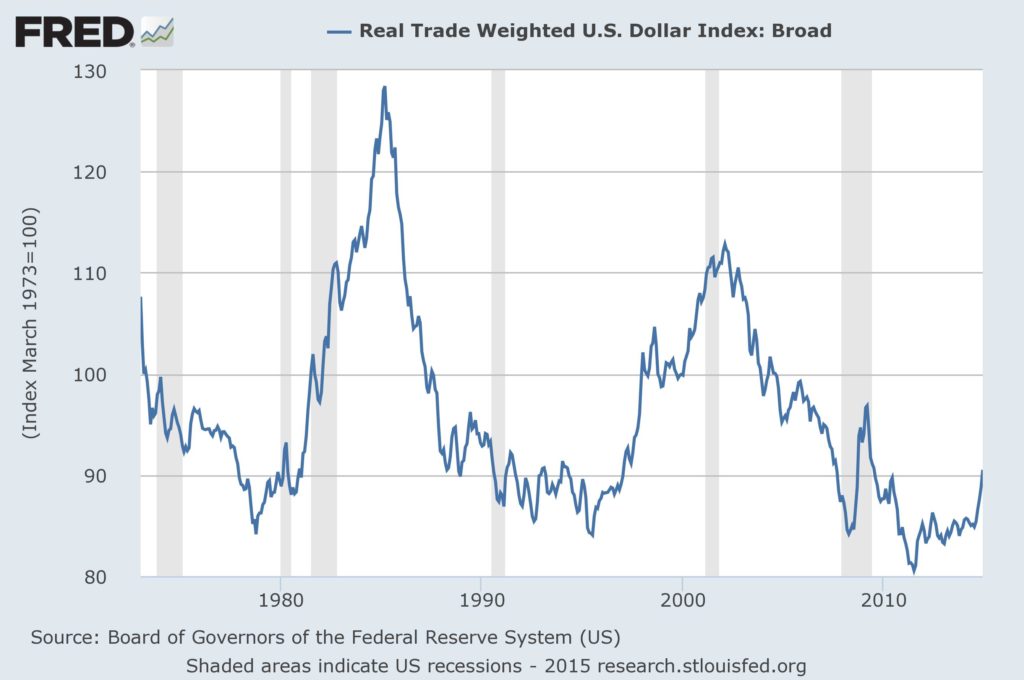

Published: 02-06-2015My quarterly letter talks about the strength of the US dollar and why it should continue to rise (see Chart below), but I wanted to note here the huge impact currencies have had on investors in the past year.

Since January 2014, US equities are up 13%. But so are European equities, and Japanese stocks are close behind (+10%). However, these numbers are in local currencies, and the euro is off 20% and the yen off 12% against the dollar this past year, so, for a US investor, in dollar terms, European equities are not up 13%, but are actually down 7%, and Japanese stocks are not up 10% but down 2%. Conversely, European investors enjoyed a 37% gain in US stocks last year (13% + 20% + compounding) and Japanese investors saw a 27% increase. From a US perspective, the gap in returns between US and European stocks is as wide as we’ve seen in over 50 years (see Chart below).

With this sort of divergence in performance, it is reasonable to look for a reversal: US stocks to underperform non-US markets. Yet, for all the reasons I noted in my quarterly letter, the US dollar could appreciate further, especially in the context of the first graph, above, where it is still relatively low historically. Dollar strength is a headwind for non-dollar assets, which I suspect will continue to blow.

Whether the dollar continues to strengthen or turns around, US markets surge to new relative highs or mean-revert, I think caution is probably in order: take modest bets and watch them closely.

Print this ArticleRelated Articles

-

![Dry Hole]() 29 Jul, 2015

29 Jul, 2015Dry Hole

Southern California just had the wettest July on record, the Angels were rained out of a home game for the first time in ...

-

![Beach Reading]() 13 Aug, 2024

13 Aug, 2024Beach Reading

Six new books for you, all fiction, all great. I hope you enjoy!The Sellout, Paul BeattyThis is possibly the most ...

-

![Shades of 2007?]() 17 Oct, 2014

17 Oct, 2014Shades of 2007?

Nice graphic in today's FT showing the spike in vol and sell-off in risk (Greek bond yields jumped from 5.5% to 9% in ...

-