-

-

-

![Michael Rosen]()

-

CIO Insights are written by Angeles' CIO Michael Rosen

Michael has more than 35 years experience as an institutional portfolio manager, investment strategist, trader and academic.

RSS: CIO Blog | All Media

Fairy Tales

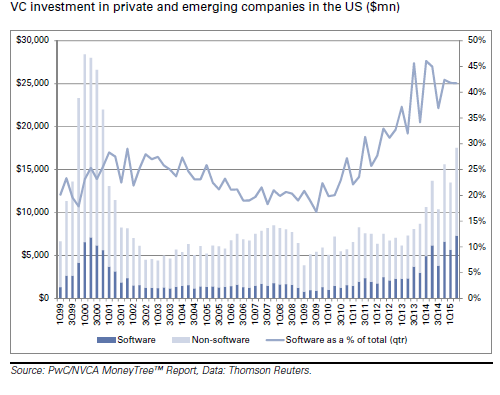

Published: 11-19-2015The technology bubble of the late 1990s is a distant memory for most investors, and an ignorance for the rest. But back then, companies were raising huge sums of private capital on business plans made of fairy dust, which is precisely what all that money turned into. Over a span of a little more than a year (4Q 1999 to 4Q 2000), well over $100 billion was funneled to private companies. Very little of it was ever returned to investors. Over this past year, just over $50 billion has been invested in private companies, the most since the bubble era, although still about half the funding levels of 15 years ago (see Chart below—note also that more than 40% of venture funding is in software).

Early Mesopotamian art and ancient Chinese and Indian myths contain references to a mythical, single-horned animal: the unicorn. The ancient Greeks saw unicorns as real, not mythological, creatures, and so do today’s investors.

There are 123 private companies receiving venture funding at valuations in excess of $1 billion (see Charts below). These are the “unicorns” of the private equity world. Unlike their peers from 2000, many of these companies are indeed “real,” with actual revenue and reasonable business plans.

Valuation, however, is a different matter. Uber, for example, is a great service, I’ve used it around the world. Is it worth five times what Hertz and AvisBudget are combined? Is Airbnb more valuable than Marriott? or Hilton? SpaceX may one day carry tourists to space, but is it worth more than Textron? Maybe yes to all of the above. Then again, who really knows?

With each round of financing, private companies see their value rise, often exponentially. That’s the natural order of the universe. But cracks are appearing that suggest the optimism may have been a little much. Dropbox had been valued at $10 billion earlier this year. Now, Dropbox is a decent service that lets you store files on-line. For free (up to 2 GB). There are other providers of the same service, and the barriers to entry are, um, none. The company raised another $350 million last month (it must be expensive offering free services), but only by agreeing to value the company at $7.6 billion. I’m not in the business of valuing private companies, but I’m not sure either number, $10 billion or $7.6 billion, is obviously correct, although directionally seems to be on the right path.

Square, another “real” business that provides a phone attachment that lets users swipe a credit card, provides a convenient service, although hardly with an obvious competitive advantage, had been valued at $6 billion in its last round of financing. It went public today at a valuation of less than half that (although, in fairness, the stock price (SQ:N) popped 40% to bring its value to $4 billion).

This is not 2000: many of the these are real, sustainable companies with valuable products and services. Whether their valuations are reasonable or are made of fairy dust may depend on whether you believe unicorns are real or mythological.

Charts courtesy: Goldman Sachs

Print this ArticleRelated Articles

-

![Beach Reading]() 18 Jul, 2025

18 Jul, 2025Beach Reading

Most of you know that Beach Reading is not a list of "summertime" romances or light novels, but rather my usual mix of ...

-

![2016 - 1st Quarter Commentary]() 17 May, 2016

17 May, 20162016 - 1st Quarter Commentary

To read more, download the full 16 page PDF: ...

-

![Fireside Reading]() 18 Feb, 2025

18 Feb, 2025Fireside Reading

Three nonfiction and three fiction recommendations for your fireside reading. Enjoy!Rat City, Jon Adams & Edmund ...

-