-

-

-

![Michael Rosen]()

-

CIO Insights are written by Angeles' CIO Michael Rosen

Michael has more than 35 years experience as an institutional portfolio manager, investment strategist, trader and academic.

RSS: CIO Blog | All Media

How The Mighty Fall

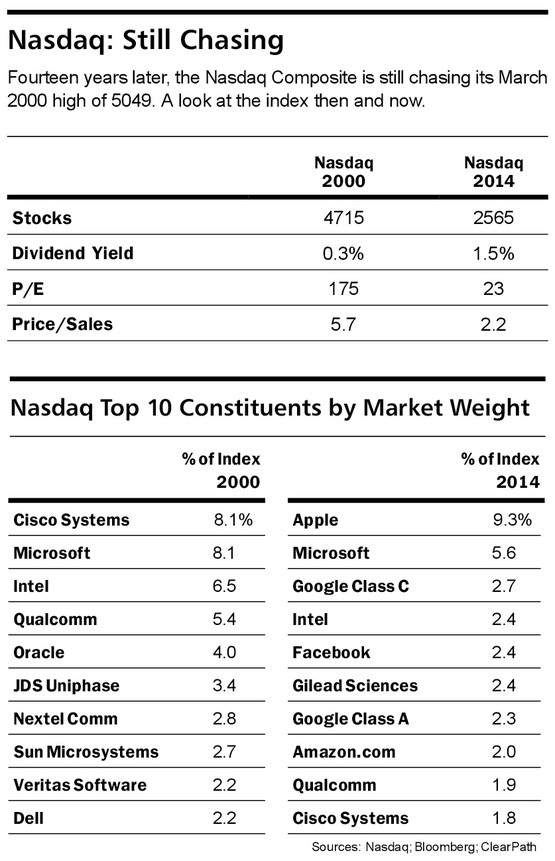

Published: 11-11-2014Between March 2000 and October 2002, the NASDAQ Index fell 75%, from over 5,000 to under 1,300. Of course, valuations were beyond silly at the peak, and I confess, following the collapse, I thought my children might one day see the index surpass its previous high.

Well, 12 years later, the NASDAQ is within 10% of its 2000 high. It’s not there yet, and it’s been a long slog to recovery, but it’s getting there.

The chart below, from Barron’s, shows the largest constituents then and now. The top 5 in 2000 still around, but 6-10 have all disappeared, either acquired or taken private. A good reminder how hard it is to stay on top.

Print this ArticleRelated Articles

-

![Two (Percent) is a Sad Number]() 21 Sep, 2020

21 Sep, 2020Two (Percent) is a Sad Number

Last month, the Federal Reserve unveiled its new monetary framework, following an intensive 18-month review. The ...

-

![Floating Oil]() 24 May, 2016

24 May, 2016Floating Oil

Oil has had a nice recovery this year (see graph for Brent, YTD), up about 18% to over $48/barrel today. Of course, this ...

-

![Bring Home the Bacon]() 16 May, 2019

16 May, 2019Bring Home the Bacon

Bacon sure is popular. McDonalds, which probably has the best pulse on Americans culinary tastes, introduced Cheesy ...

-