-

-

-

![Michael Rosen]()

-

CIO Insights are written by Angeles' CIO Michael Rosen

Michael has more than 35 years experience as an institutional portfolio manager, investment strategist, trader and academic.

RSS: CIO Blog | All Media

Humans! What Are They Good For?

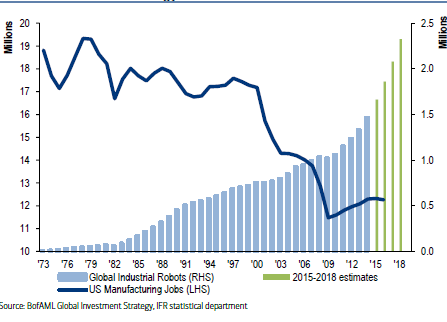

Published: 06-29-2017It looks like the world is turning against humans. I’ve talked before about the rise of robots in manufacturing (2016 Angeles Independent School Endowment Symposium…see graph below). But robots are taking on increasingly more complicated tasks. We may be comfortable with robots assembling our cars (although the UAW may take exception), but most us will soon be forced to shift our perception of our family physician from Robert Young (aka, Marcus Welby, MD, which is showing my age) to Da Vinci (no, not Leonardo…see photos below).

The Rise of Robots, The Descent of Humans

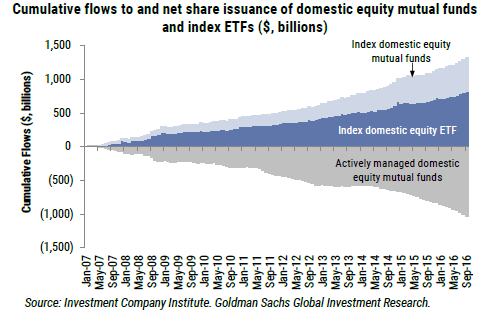

It seems that investors, too, have given up on humans being able to pick stocks. Money has flowed consistently out of actively managed funds and into passive vehicles (see graph below), which now account for 40% of US funds.

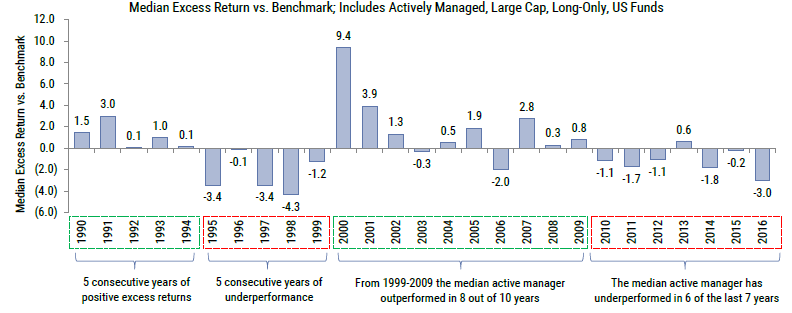

It’s hard to blame investors for moving to passive management: performance by active managers has been poor for years. Using the eVestment database of 1,298 large cap, long-only, US equity funds, 761 of which are currently open (the rest have closed, merged or otherwise disappeared), holding $2.5 trillion of assets, shows that last year the median fund trailed its benchmark by 300 basis points (net of fees), the worst relative result since the dot-com boom of 1998. Only 20% of funds outperformed at all, the lowest percentage since at least 1990 (n.b.: all of these numbers were crunched by our friends at Goldman Sachs).

So, it’s no surprise that in the face of this abysmal performance investors have turned away from active managers. Regulators, too, are joining the anti-active manager chorus. The Financial Conduct Authority (FCA), the main regulator in the UK, issued a scathing report this week on the entire professional asset management community, chastising managers for high fees and poor performance, and investment consultants (not us!) for poor advice and no accountability (https://www.fca.org.uk/publications/market-studies/asset-management-market-study—I encourage you to read it).

I think the charges of the FCA report are largely valid, so I won’t offer a rebuttal. But I do want to explore this increasingly accepted notion that active managers are doomed to go the way of Rosie the Riveter and Marcus Welby.

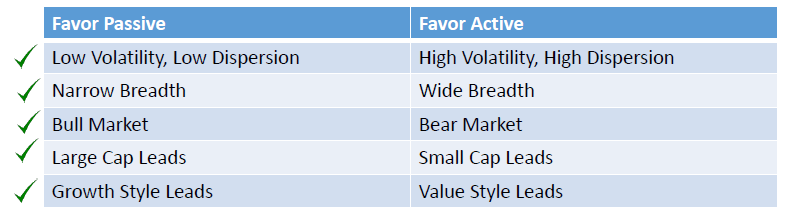

It’s been awhile, but there have been past periods of active management outperformance (as the graph above shows), and we observe several market conditions that seem to explain part (most?) of manager relative performance. The table below summarizes these conditions, all of which currently favor passive over active management.

So, to a certain extent (maybe to a large extent), a bet on passive outperforming active is a bet that the above conditions will persist. Good luck with that bet, because I can offer no insight on this. I am highly confident that one day these conditions will change. I am also highly confident that I have no idea when that will be.

The bigger point is that for us, this passive/active debate is a false dichotomy: we don’t have to choose, and for most of our clients, we have structured portfolios with both passive and active allocations. We think it’s been an effective approach. As of the most recent (March) quarter, all of our composite strategies have outperformed their benchmarks over the trailing year (as well as over the past 3-, 5-, 7-, 10- years—although this is where I rightly warn that past performance is no guarantee of future results). Maybe we’ve just been lucky, or maybe we’re smart and hard-working (I have my opinion, you can form your own).

The current environment has been highly favorable for passive management, and low fees are certainly a very attractive attribute of passive funds. But, as Benjamin Graham taught us, price is what you pay, value is what you get. And in seeking value, we still believe in humans.

Print this Article

Related Articles

-

![Fireside Reading]() 8 Feb, 2022

8 Feb, 2022Fireside Reading

It's beach weather in LA this week, but in deference to the rest of the country, we'll stay with Fireside Reading. Three ...

-

![Negative Negative is Positive]() 22 Aug, 2016

22 Aug, 2016Negative Negative is Positive

Housing is a small part of the larger economic picture, contributing only about 5% to GDP (although includingÂall ...

-

![Im Not Dead!]() 24 Oct, 2014

24 Oct, 2014Im Not Dead!

A great line from a great Monty Python movie, and another crisp cover from The Economist: ...

-