-

-

-

![Michael Rosen]()

-

CIO Insights are written by Angeles' CIO Michael Rosen

Michael has more than 35 years experience as an institutional portfolio manager, investment strategist, trader and academic.

RSS: CIO Blog | All Media

Not Deflation

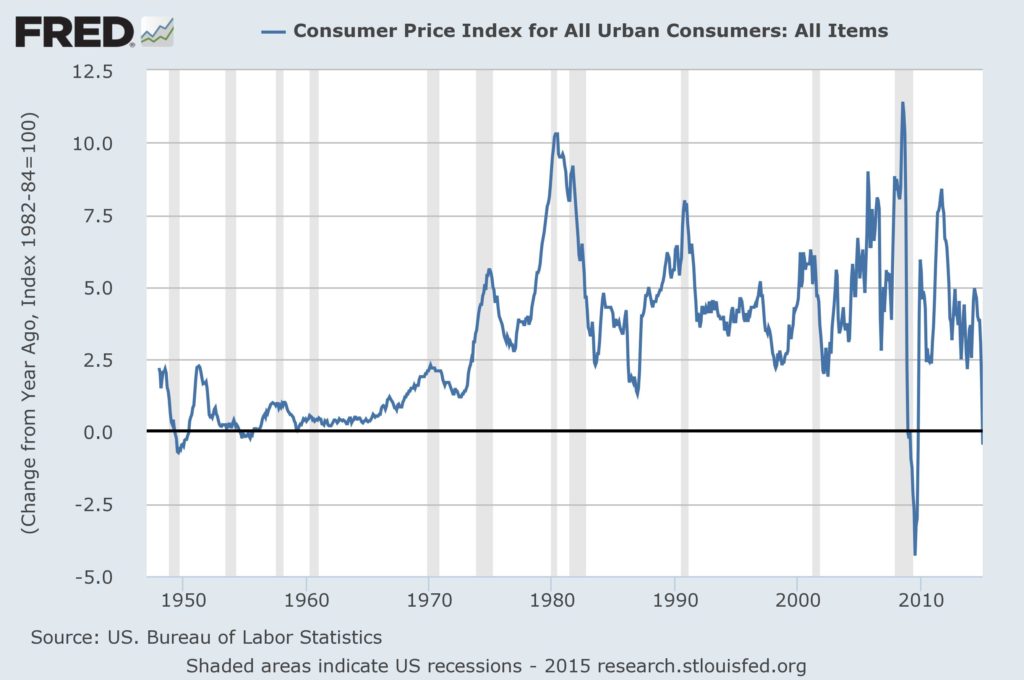

Published: 02-26-2015The Consumer Price Index dropped 0.7% in January, bringing the year-over-year change to negative 0.1%. With the exception of the 2008 financial meltdown, the January decline brought the index to its first negative annual change since 1949 (see Chart below).

Energy is behind this. Energy prices fell 9.7% in January, and are down 19.6% over the last 12 months. Ex-energy, CPI is up 1.9% from a year ago.

This is not deflation, which is caused by tight money, but rather a one-off drop in the price of an important commodity.

The headline number also obscures encouraging data on income. Real (after-inflation) incomes rose for the fourth straight month, are up 2.4% from a year ago, and have accelerated to a 4.9% annualized pace over the past six months.

The decline in energy prices is a transfer of wealth from producers to consumers. It is not deflation, or anything other than that. Full stop.

Print this ArticleRelated Articles

-

![Rebalancings]() 16 Mar, 2015

16 Mar, 2015Rebalancings

Apologies for slipping on the blogs, but I've been traveling around the continent, from Alaska to DC.One of the more ...

-

![Selected Fun Facts]() 14 Nov, 2014

14 Nov, 2014Selected Fun Facts

Some fun facts about this year (courtesy Michael Hartnett of Merrill Lynch):US equities (+14%) are ahead of European ...

-

![Petropolitics]() 2 Dec, 2014

2 Dec, 2014Petropolitics

For the past few years, oil has held steady at around $100/barrel, as supply and demand were largely held in check. ...

-