-

Reversal

-

-

![Michael Rosen]()

-

CIO Insights are written by Angeles' CIO Michael Rosen

Michael has more than 35 years experience as an institutional portfolio manager, investment strategist, trader and academic.

RSS: CIO Blog | All Media

Reversal

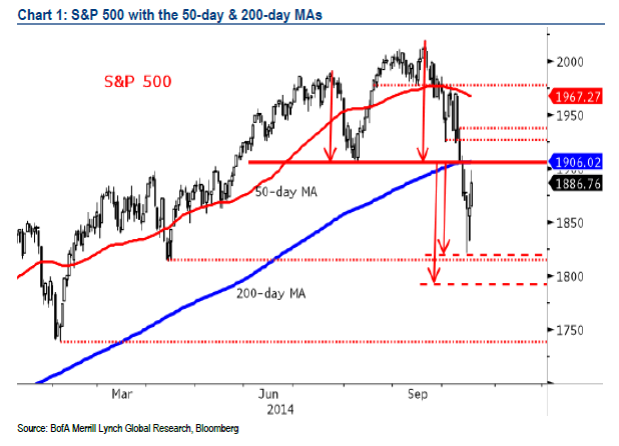

Published: 10-21-2014I’m interpreting the spike down last week and the strong rebound in the past few days as bullish. See the chart below from Friday’s close (courtesy of our friends at Merrill).

We have held our positions in our model portfolios, neither panicking during the deluge nor trying to catch the bottom of this short-term move. Remember that much of what happens hour-to-hour, day-to-day, week-to-week, even year-to-year, has (or should have) little practical impact on long-term investors. Let’s make sure we have the cash to pay the bills and cover reasonable contingencies; after that, we can be largely indifferent to the spasms of the markets.

Print this Article

Related Articles

-

![Balance]() 29 Oct, 2019

29 Oct, 2019Balance

October 1987 was a memorable month for me. It began with the 5.9 magnitude Whittier Narrows quake that rocked my ...

-

![Shades of 2007?]() 17 Oct, 2014

17 Oct, 2014Shades of 2007?

Nice graphic in today's FT showing the spike in vol and sell-off in risk (Greek bond yields jumped from 5.5% to 9% in ...

-

![Fireside Reading]() 15 Dec, 2020

15 Dec, 2020Fireside Reading

Since my last update a few months ago (https://www.angelesinvestments.com/institutional-insights/still-beach-reading), ...

-