-

-

-

![Michael Rosen]()

-

CIO Insights are written by Angeles' CIO Michael Rosen

Michael has more than 35 years experience as an institutional portfolio manager, investment strategist, trader and academic.

RSS: CIO Blog | All Media

Spreads

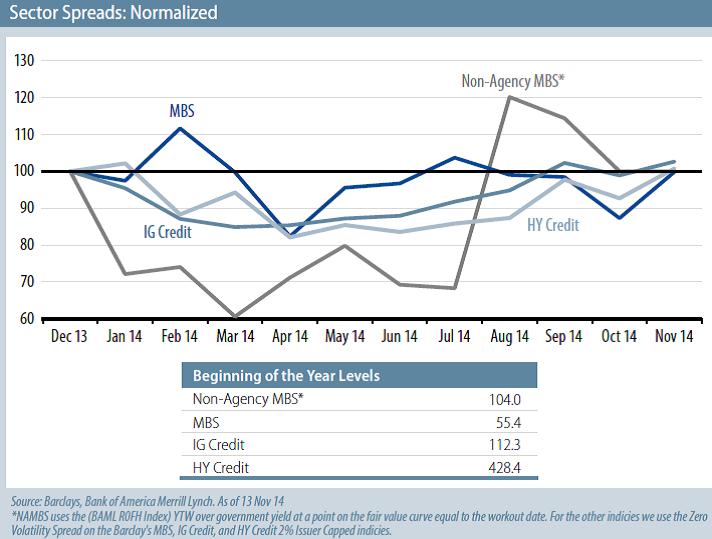

Published: 11-18-2014An interesting graphic from Ken Leech of Western Asset showing that spreads in Bondland this year are pretty much unchanged from the start of the year. This, despite the rally in US equities and solid economic growth. Thus, Ken concludes, spread products remain attractive.

I agree. There are numerous risks in fixed income, but that’s often the case. An economy that suddenly slumps will likely cause spread widening (although likely offset by rising bond prices). An unexpected economic boom could push bond prices lower (but spreads should hold true, if not tighten). An environment of moderate growth and low inflation should be favorable to spread products. And that’s my view.

Print this ArticleRelated Articles

-

![Beach Reading]() 29 Jul, 2021

29 Jul, 2021Beach Reading

A few more outstanding books for your summer reading...Black Buck, Mateo AskaripourThis is an exceptional debut novel ...

-

![It's a Big World]() 3 Nov, 2014

3 Nov, 2014It's a Big World

With apologies to Walt Disney, the global economy is getting, well, more global, and, intuitively, companies' ...

-

![Jobs]() 4 Sep, 2015

4 Sep, 2015Jobs

Markets have taken today's employment release as evidence of a weakeningÂjobs market. A mere 173,000 net new jobs ...

-