-

The Present is the Future (at least in bond land)

-

-

![Michael Rosen]()

-

CIO Insights are written by Angeles' CIO Michael Rosen

Michael has more than 35 years experience as an institutional portfolio manager, investment strategist, trader and academic.

RSS: CIO Blog | All Media

The Present is the Future (at least in bond land)

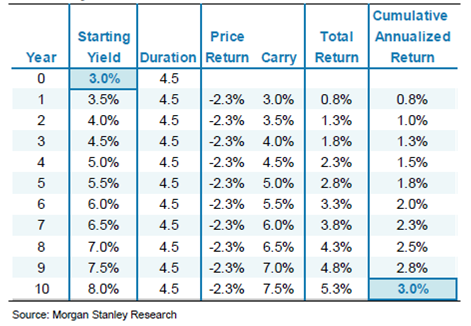

Published: 10-27-2014In our long-term assumptions, we generally assume that the total return in fixed income is pretty close to its starting yield. That’s because a bond’s total return is a function of two variables: yield and re-investment yield. As yields move up and down, bond prices move inversely, down and up, but the re-investment rate moves positively with yields. In the short-term, changes in prices have a large impact on total return, but given enough time, the re-investment yield (almost) completely offsets the price/yield function.

The table below (courtesy Morgan Stanley), shows the effect of interest rates rising from 3% to 8% at 50 basis points a year over 10 years. The total return over this decade works out mathematically to 3%, (not) coincidentally the starting yield.

There are risks to owning bonds, primarily higher inflation, and to a lesser extent default risk. But the laws of mathematics make us highly confident that the long-term nominal return for bond investors will be right around today’s yield.

Print this Article

Related Articles

-

![Sunrise or Sunset: Thoughts on a Post-Pandemic World (Part 2)]() 29 May, 2020

29 May, 2020Sunrise or Sunset: Thoughts on a Post-Pandemic World (Part 2)

In Part 1 ...

-

![Dry Hole]() 29 Jul, 2015

29 Jul, 2015Dry Hole

Southern California just had the wettest July on record, the Angels were rained out of a home game for the first time in ...

-

![Fireside Reading]() 18 Feb, 2025

18 Feb, 2025Fireside Reading

Three nonfiction and three fiction recommendations for your fireside reading. Enjoy!Rat City, Jon Adams & Edmund ...

-